Why Schools Should Take Card Payments

As financial pressures evolve in the independent sector, particularly following VAT changes on school fees, many schools are reassessing how they collect payments. One increasingly popular option is to offer parents the ability to pay by card.

While card payments have long been standard elsewhere, their adoption in schools is still growing. So, why should independent schools consider taking card payments, and when does it make sense to do so?

Meeting parents where they are

Parents today expect simple, secure, and instant ways to pay. From weekly shops to travel bookings, card payments are second nature and schools can meet those expectations by offering the same flexibility. Whether it’s for fees, trips, books or uniforms, card payments allow parents to pay quickly and easily without switching between systems or payment types.

Flexibility when it’s needed most

For many families, termly fees represent one of their biggest household expenses. With the recent introduction of VAT, some may face additional strain on cashflow. Card payments offer flexibility; particularly for parents who wish to manage larger payments on credit cards, spreading the cost in a way that suits their own finances.

In fact, recent research by Pepper Money found that:

“23% of parents affected by VAT changes plan to use credit cards to help cover school fees.”

This shows that, in times of financial pressure, families are already looking for manageable, short-term ways to stay on top of payments.

By enabling card payments, schools can proactively support this need; helping parents avoid resorting to long-term loans or financing options that may cost them more overall.

For schools, this flexibility can reduce the risk of delayed or missed payments, maintaining predictable income throughout the year.

Improving cashflow and reducing missed payments

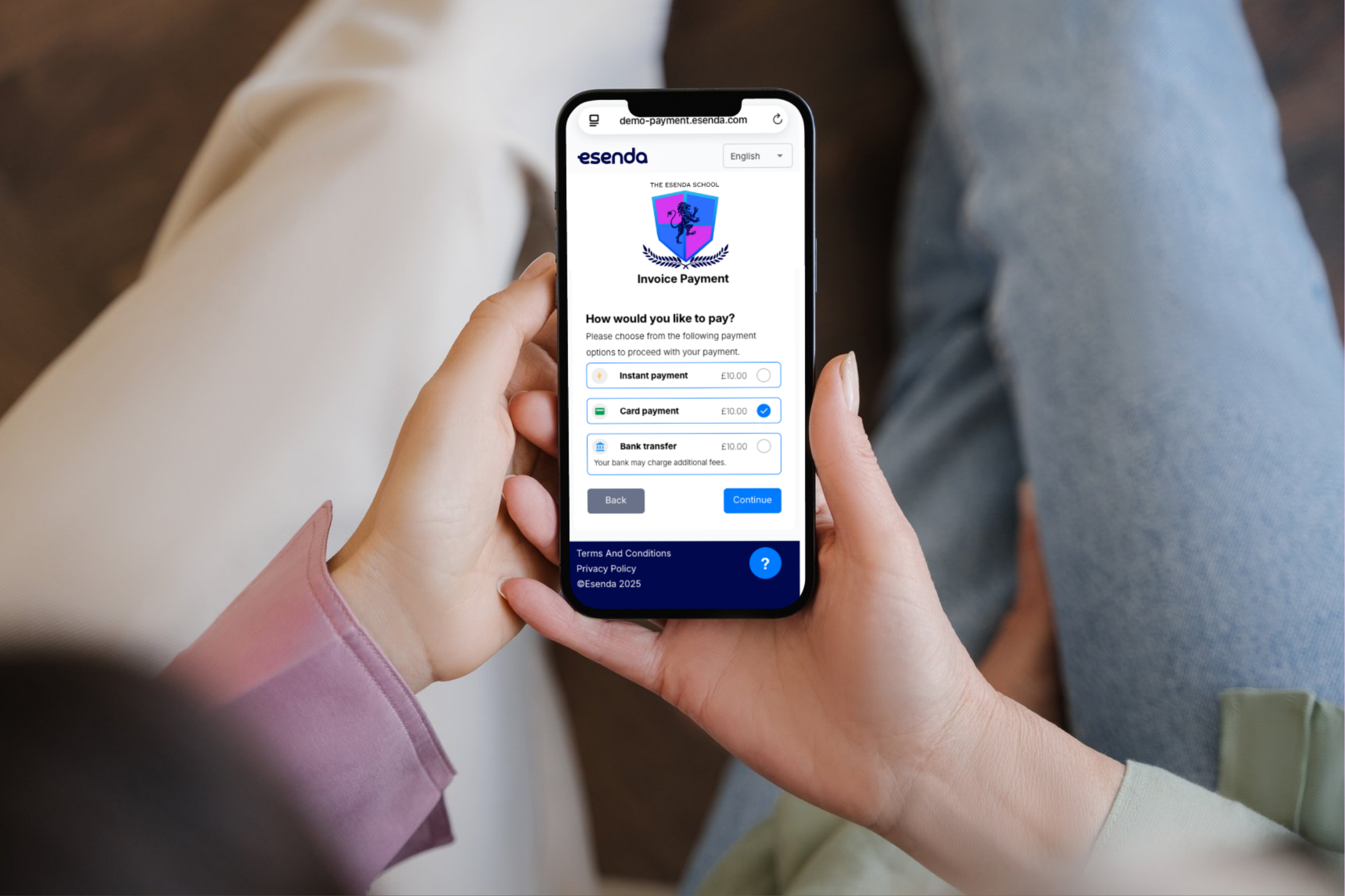

When parents can choose how to pay, whether it’s via direct debit, BACS, or card, they’re more likely to make payments on time. Offering multiple options helps schools improve cashflow, save administrative time, and reduce arrears.

And sometimes, absorbing a small percentage transaction fee is far better than losing the entire payment altogether.

Supporting international and overseas families

For schools with a global community, card payments can be a lifeline. They eliminate international transfer delays and exchange rate confusion, allowing parents abroad to pay instantly and securely in their local currency.

Strengthening security and reconciliation

Modern payment gateways are highly secure and fully compliant with banking regulations, helping schools protect parent data and reduce the risks of manual processing. Online card payments are automatically recorded and tracked, simplifying reconciliation and supporting audit-ready reporting.